The price of a stock is determined after a company decides to go public and issue an initial public offering (IPO). The company works with investment bankers to assess how many shares can be offered and at what price, using sophisticated valuation techniques.

After the initial offering, the stock is traded on a secondary market, such as the New York Stock Exchange (NYSE) or NASDAQ. Here the value of the stock depends on supply and demand. A low supply and high demand will increase the price of a stock, while a high supply and low demand will decrease the price of a stock.

Dividend declaration also affects the stock price. If dividends are higher than expected, stock prices tend to rise, and vice versa.

Economic booms, recessions, political environment and market sentiment are a few other factors that affect the value of stocks.

What is a CFD on a stock?

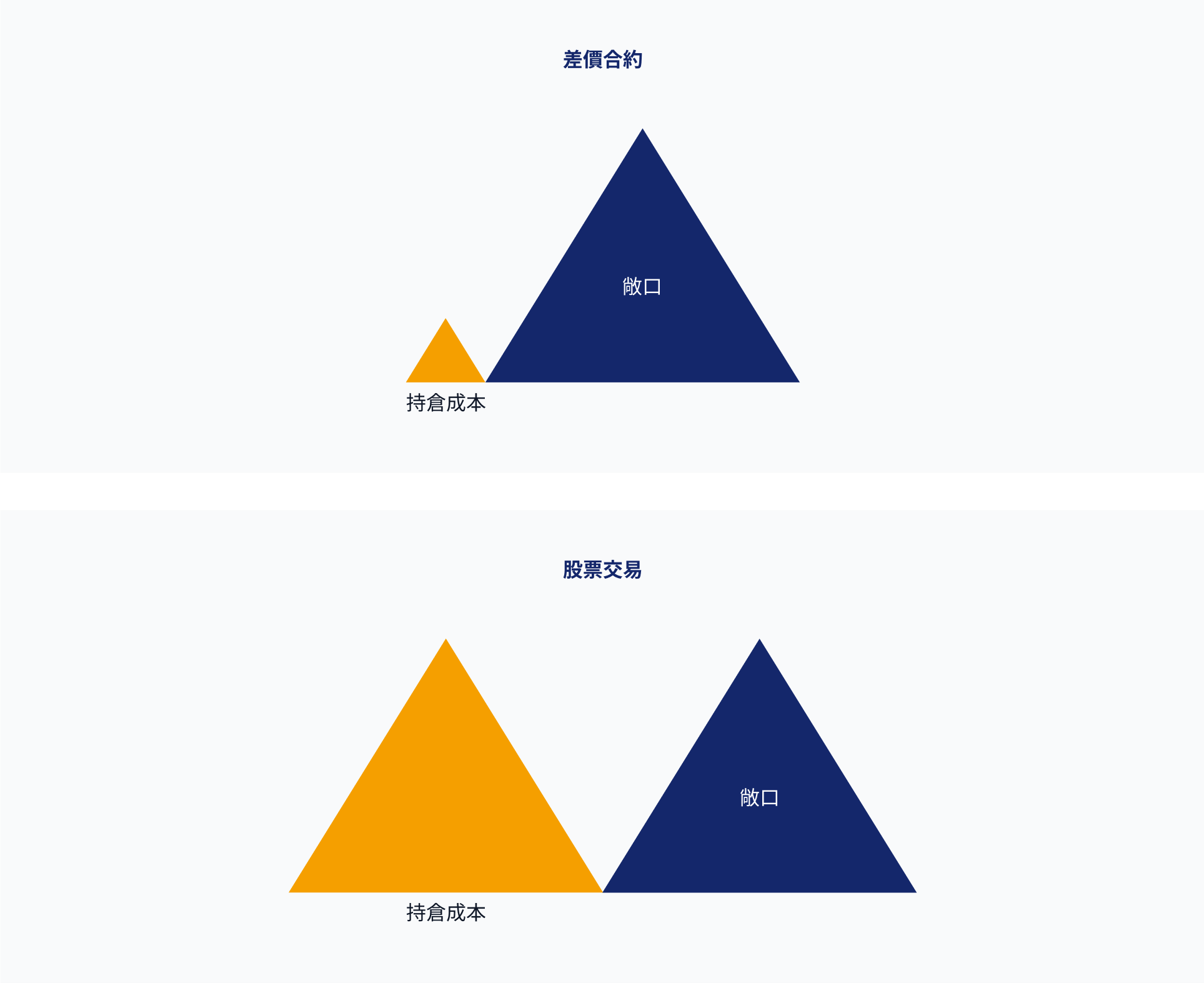

Sometimes shares are traded as Contracts for Difference (CFDs). This means that you don't own the stock, you just trade the price fluctuations.

CFD trading allows you to speculate on price movements in any direction. So while you can take profits if the market goes up, you can also open a CFD position that will take profits if the market price goes down. This is called selling or "going short" rather than buying or "going long".

For example, if you think the price of Google stock is going down, you can short and sell CFDs on the company's stock.